Japan Leads the Sober Curious Culture in Asia Pacific

Sober curious culture is a trend that is about drinkers trying to moderate their consumption levels rather than fully abstaining from alcohol. This movement originated in Western countries and has now spread widely in the West. In Asia Pacific, the concept is only at a stage where it is known to a small number of people. However, in Japan, the first signs of the sober curious trend are emerging, as “dry” initiatives are beginning to take place.

After the pandemic, the sober curious trend is slowly growing in Asia Pacific

In the Asia Pacific region, particularly in East Asia, drinking has traditionally played a major role in building relationships. Collectivist values also make it difficult to refuse alcohol at drinking parties. However, after experiencing the pandemic, the situation is slowly changing. The flexible working style brought about by the pandemic has reduced unnecessary drinking parties, and increased health awareness has led to more people opting for non-alcoholic drinks.

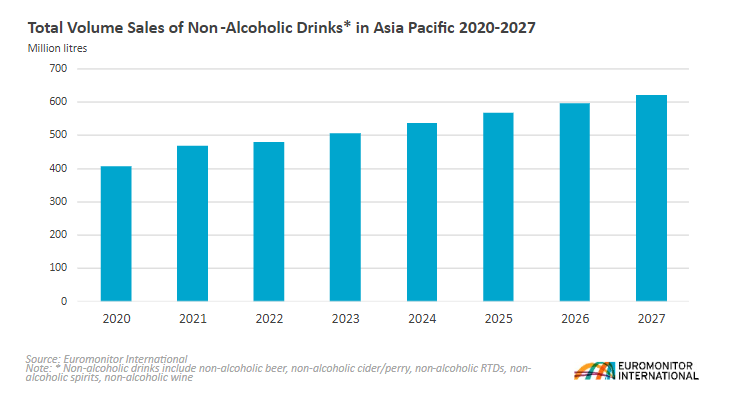

The total volume sales of non-alcoholic drinks recorded 481 million litres in 2022, and the market is expected to grow at a 5% CAGR between 2022 and 2027, reaching 621 million litres, an increase of 29% from 2022.

Health is the main reason to reduce alcohol consumption

Health is the major factor in encouraging Asia Pacific consumers to moderate their intake of alcohol. According to Euromonitor’s Voice of the Consumer: Health and Nutrition Survey, four of the top five reasons to reduce alcohol are health-related factors.

In response to health concerns, non-alcoholic products with functionality are popular. For instance, in Japan, the largest non-alcoholic drinks country in Asia Pacific accounting for 71% of the total volume sales in 2022, there are various products with functional claims, especially in non-alcoholic beer.

Popular claims are mainly related to obesity prevention such as reducing visceral and abdominal body fat or reducing absorption of dietary fat and sugar. However, in the past few years, diverse claims are emerging such as lowering uric acid levels and reducing fatigue.

Drinking is not a time-effective activity for the young generation

There is no doubt that products with functional claims are an attractive option for those seeking to cut back on alcohol for health reasons. For young people, however, it seems that health concerns are not the only reason they are turning away from alcohol.

In the first place, young people do not drink alcohol as habitually as older generations do.

Over 10% of respondents aged over 40 said they drink alcohol almost every day, compared to 3% and 7% of those in their 20s and 30s, respectively

The result suggests that, for many young consumers, alcohol is becoming something that does not have to be with them in their everyday life. This coincides with the young consumers’ pursuit of time.

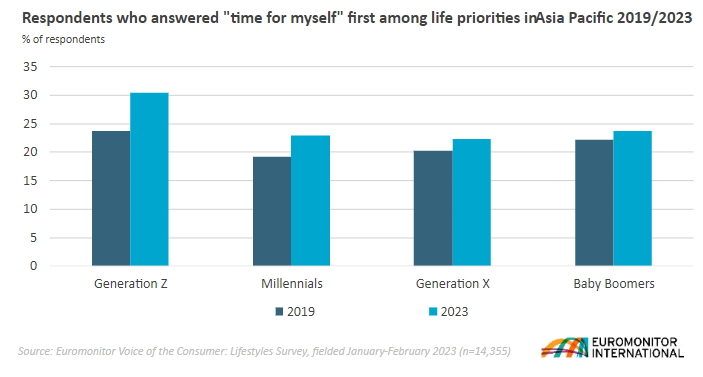

From 2019 to 2023, respondents who chose “time for myself” as their first life priority recorded the biggest growth among Generation Z, reaching 30% in 2023

For young people who value their time for themselves, attending old-fashioned drinking parties or spending their precious free time after work getting drunk is becoming a waste of their time. Drinking is becoming an inefficient pastime for the young generation.

“Dry” initiatives are taking place in Japan

In response to these changes in young people, alcohol companies are changing their strategies. In 2022, Asahi Breweries Ltd opened a bar in Japan that features sober curious value. Customers can choose from over 100 kinds of drinks such as craft cola and lemonade, and they can order the drinks with the alcohol content that they prefer, ranging from 0% to 3%. The bar is located in Shibuya, a popular area for young people.

Also, shopping centre operator PARCO, targeting the young segments, has conducted a campaign featuring Dry January since 2022. Dry January is a public health initiative that originated in the UK to challenge participants to give up drinking alcohol in January, which is the month after December when people tend to drink lots of alcohol. During the campaign in 2023, PARCO featured non/low-alcohol drinks from 20 companies both in the PARCO online store and in select outlets.

These “dry” initiatives are still niche in Japan but are expected to become bigger in the next couple of years, followed by other Asian countries in the future. In fact, the world’s first non-alcoholic baijiu (Chinese distilled spirits with ABV around 50%) was launched by Lyre’s Spirit Co in China in 2022. Considering that a higher proportion of the population in Asia Pacific is alcohol-sensitive by nature than in the West, the sober curious trend has great potential to grow in this region.

Learn more about the challenges and opportunities of the beverage industry in our report, Alcoholic Drinks in Japan.