Beer in Sweden - Market Forecast 2023

KEY DATA FINDINGS

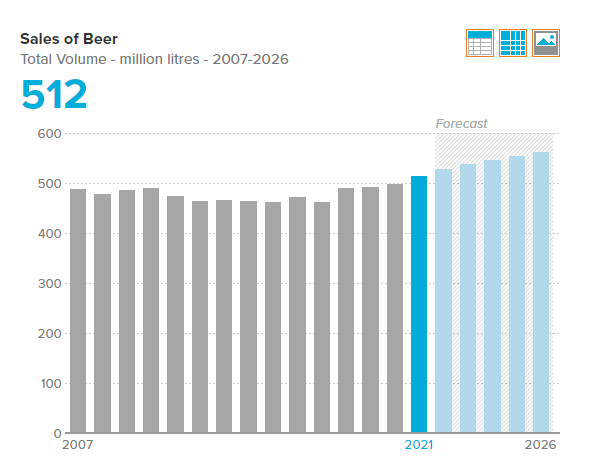

Total volume sales increase by 3% in 2021 to 512 million litres

Low alcohol beer is the most dynamic category in 2021, with total volume sales growing by 9% to 125 million litres

Spendrups Bryggeri AB remains the leading player in 2021, with a total volume share of 32%

Total volume sales are set to increase at a CAGR of 2% over the forecast period to reach 561 million litres in 2026

Beer in Sweden

2021 DEVELOPMENTS

Beer sees improved performance in 2021 as on-trade sales see partial recovery

Beer saw stronger growth in total volume terms in 2021 compared to the previous year, with this being backed by a partial recovery of on-trade demand as restrictions were eased. Lager remains the dominant beer category in Sweden, with domestic premium lager being the most popular option. Nonetheless, non/low alcohol beer was the most dynamic category in 2021 with it cannibalising sales of standard lager. Ale continues to be a novelty choice as development is slow and interest is limited.

Non/low alcohol beer thriving as consumers pursue healthier lifestyles

Health and wellness has become an even more important trend in Sweden since the COVID-19 pandemic. Some people have looked to adjust their diet and lifestyle, with this supporting an ongoing shift towards non/low alcohol beer. Non/low alcohol beer is also popular due to the fact it can be distributed through grocery retailers and online, whereas beer with an alcohol content above 3.5%ABV can only be sold through Systembolaget stores. For consumers aged 18 or 19 the only option when purchasing beer through retail channels is non/low alcohol beer, with Systembolaget stores having a minimum age limit of 20 years.

Non alcoholic beer has also been steadily increasing in popularity in Sweden in recent years, with this trend continuing in the same direction during 2021, not least online. This was supported by several factors including the growing trend towards sobriety among younger consumers as well as the ever expanding range of options from both the major players and smaller breweries.

Beer continues to be dominated by Spendrups Bryggeri and Carlsberg Sverige AB

The competitive landscape in beer remains dominated by Spendrups Bryggeri and Carlsberg Sverige AB. Spendrups Bryggeri AB is a Swedish family-owned company and it retained its leadership in 2021, taking further total volume share from its closest rival Carlsberg. Spendrups Bryggeri continued to increase its sales through Systembolaget while also benefiting from the partial recovery of the on-trade channel, with the latter having experienced a significant drops in demand during 2020. The leader’s strength is linked to its convincing leadership of the largest category, domestic premium lager, through a range of brands including Mariestads, and Norrlands Guld with the latter gaining notable share in 2021. It also has a growing presence in imported premium lager through Krušovice (GBO Heineken NV), which also continued to gain share in 2021 in addition to recording double-digit total volume growth. However, Spendrups Bryggeri’s consumer loyalty is mainly supported by being a local, family-owned business with a growing focus on sales of organic beer, which continued to gain in popularity over the review period. The dominance of Spendrups Bryggeri and Carlsberg makes it harder for new entrants to get a foothold in the market and as such new product development often revolves around known brand expansions with new flavours or non/low alcohol variants.

PROSPECTS AND OPPORTUNITIES

Normalisation should support demand through both the on-trade and the off-trade

On-trade beer sales should continue to see a recovery over the forecast period, but they are not expected to return to return to pre-pandemic sales levels until 2025 (in volume terms). While fears around COVID-19 have largely subsided high rates of inflation and economic concerns are expected to dissuade some consumers for venturing out as frequently as before. Additionally, some people became less inclined to socialise during the pandemic and it may take some time before consumers return to their old habits.

A positive driver for off-trade sales in 2022 should be the full return of cross-border trade with Norway, with Sweden’s border restrictions being fully lifted on 1 April 2022. This included removing the need to present a vaccination certificate or a negative COVID-19 test result. Cross-border shopping trips to Sweden are common in Norway, especially for those living in the southeast of the country. Due to the high taxes on alcohol many Norwegians take trips to Sweden to stock up on beer and other alcoholic drinks, with these visitors being an important revenue source for Systembolaget stores.

Non alcoholic beer set to retain its appeal with strong growth projected

After another strong showing in 2021, non alcoholic beer is expected to continue recording healthy growth over the forecast period in both off-trade and on-trade volume terms. Sales should be supported by the increasing focus on leading healthier lifestyles, a trend which will likely be particularly driven by the younger adult demographic. Non alcoholic beer should also benefit from being deemed an attractive alternative to soft drinks while being healthier than regular beer given the absence of alcohol. Its low retail prices due to the absence of excise tax payable on non alcoholic beer will also appeal to consumers, who will likely remain price-sensitive heading into the forecast period due to the sharp rise in food and energy prices and the threat of inflation. Furthermore, new products will likely also continue to enter the market offering new and interesting varieties to consumers. For instance, AB InBev announced the launch of its new non alcoholic beer Corona Cero in June 2022. Another selling point of the product is that it is made with 100% natural ingredients, which will likely also appeal to Swedish consumers.

Investment in new product development and sustainability expected as players look to stand out in the market

With overall beer consumption expected to remain relatively stable, it is likely that prevailing trends will continue to influence the market. This will likely include the growing attention being paid to local craft beer, the introduction of new types of non-lager beer, and an increasing interest in non-alcoholic beer. As in most areas of life in Sweden, there will likely also be a growing focus on issues around sustainability. Players will likely put greater efforts into introducing more sustainable packaging, as well as deploying more sustainable production practices, such as using renewable energy sources. There is also likely to be a growing focus on beer which is seen to be purer and which uses local, organic and natural ingredients. E-commerce could also present new opportunities, with this adding an additional layer of convenience and potentially helping to raise awareness about less familiar brands and beer varieties.

CATEGORY BACKGROUND

Lager price band methodology

When deciding on price bands, domestic beer brands sold through regular off-trade outlets such as ICA and Coop (which cannot have an alcohol content above 3.5%ABV) are assumed to be mid-priced. Examples of such brands include Mariestads, Carlsberg Lager and Heineken. These do not cost more than SEK26.48/litre when bought in multipack formats.

Hence if the unit price of a brand is SEK26.50 or more it will be classified as premium. Most of the brands being sold through Systembolaget are classified as premium brands, since the price increases for beer with a higher alcohol content and if not sold in multipacks. Some imported brands which are premium can be found in regular off-trade outlets (providing their alcohol level does not exceed 3.5%ABV), due to their higher than SEK26.50/litre unit price even when sold in multipacks. Examples of these include Corona Extra (3.2%ABV), Budweiser (3.5%ABV) and Krušovice Imperial (3.5%ABV).