PACRIM'S SUMMARY FOR CRAFT BEER IN SWEDEN

KEY DATA FINDINGS

Despite flat off-trade volume growth in 2020, notable shift in consumption patterns amongst different types of beer as consumers reduce frequency of visits to on-trade channel during pandemic

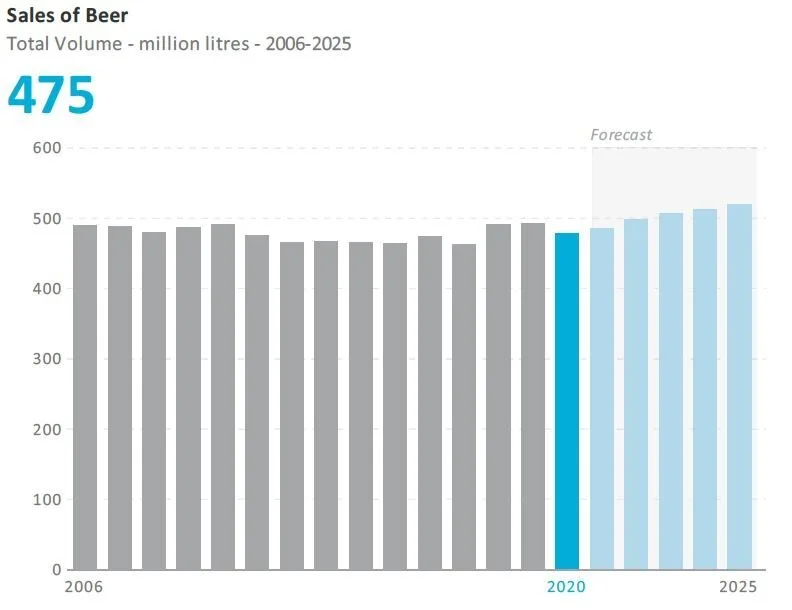

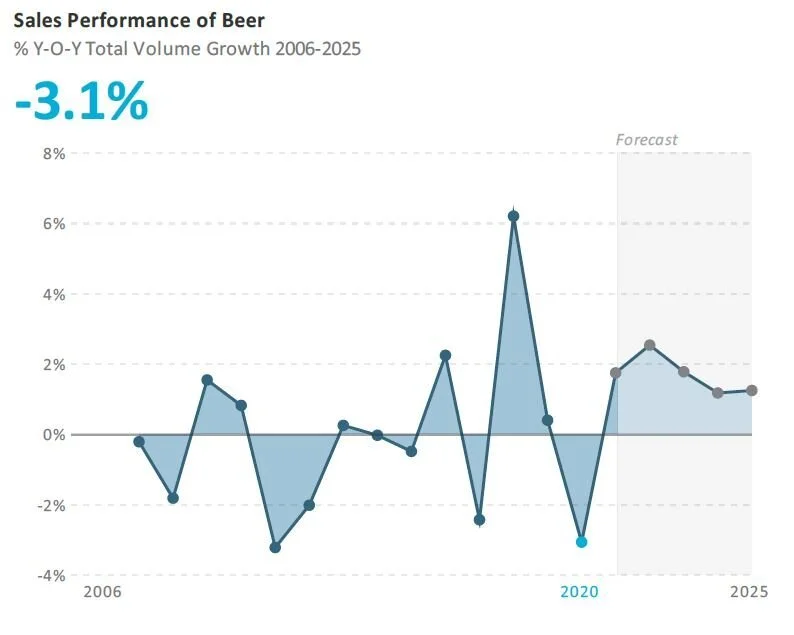

Beer declines by 3% in total volume terms in 2020, falling to 475 million litres

Ale records highest total volume growth of 9% in 2020 to reach 22 million litres

Average unit price of beer declines by 7% in total current value terms in 2020

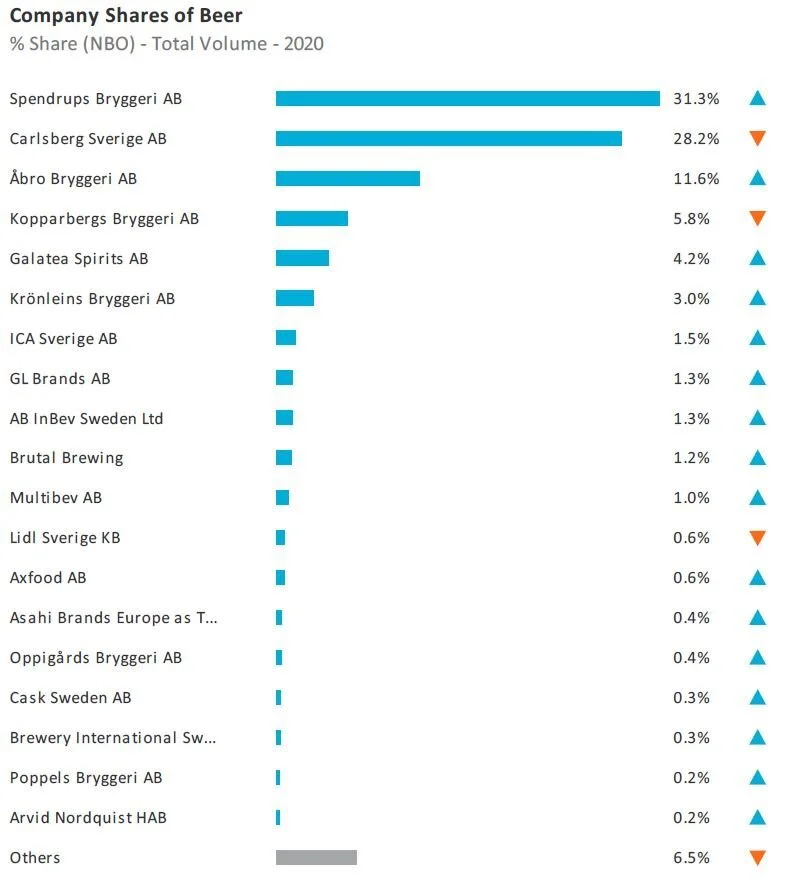

Spendrups Bryggeri AB retains leadership of beer in 2020 with a 31% total volume share

Over the forecast period, beer is predicted to record a 2% total volume CAGR to reach 517 million litres in 2025

Craft Beer Market Size in Sweden 2021.JPG

COVID 19 IMPACT

Despite upturn in demand for a number of different beer types through off-trade, sales are unable to offset weak performance of on-trade during pandemic

Total volume sales of beer experienced decline in 2020 as a result of the pandemic. While horeca outlets were allowed to remain open in Sweden, they had to implement strict social distancing measures to prevent crowded areas in the premises and to keep to table service only in the case of dining. Strict monitoring of these premises by government authorities meant the closure of outlets found to not be operating within the new restrictive rules. Combined with caution amongst Swedish consumers being in public spaces with the virus in circulation, demand for beer through on-trade was significantly impacted, with the channel recording double-digit volume decline.

Sales of Beer by Category in Sweden 2021.JPG

There is a culture of drinking alcoholic drinks at home in Sweden before going out leading to the dominance of off-trade sales of beer. While such activity was somewhat diminished in 2020, there was still a greater shift towards home consumption as consumers took to entertaining and relaxing more at home, resulting in stronger offtrade volume sales of the largest category, domestic premium lager, as well as other more niche areas such as ale, weissbier/weizen/wheat beer and stout as Swedes redirected their expenditure towards small indulgences with these beer types typically carrying much higher than average unit prices.

Nevertheless, off-trade volume sales of beer stagnated in 2020, impacted by the ongoing weak performance of low alcohol beer which holds significant share overall. This category has been gradually losing ground to non alcoholic beer in Sweden, as health-conscious consumers became increasingly attracted to the concept, resulting in a run of impressive growth rates prior to the pandemic. However, during a stressful period due to the pandemic, non alcoholic beer experienced double-digit declines as an increasing number of Swedes switched to alcoholic drinks whilst relaxing at home. This prompted Carlsberg, which leads non alcoholic beer through its leading brand Carlsberg Non-Alcoholic, and has a presence in low alcohol beer with Falcon, to launch a campaign between 4-20 November 2020 in an attempt to boost sales for the latter. Swedish consumers could send a bottle of Falcon Winter Brew together with a personal greeting to friends or family around the country during a difficult time.

Independent breweries, significantly impacted by loss of on-trade sales attempt to expand distribution

A high number of breweries in Sweden are independently owned and many rely on the on-trade channel, with some local beer producers claiming that up to 70% of their sales are via bars, festivals, and public events. When concerts and public events were stopped as a result of the pandemic and bars were forced to observe social distancing measures, small breweries reviewed their strategies and product portfolios in an attempt to survive the hostile environment. This resulted in some switching to soft drinks or folkol (low alcohol lager) with the latter offered for home deliveries, in addition to expanding their distribution through the Systembolaget monopoly of alcoholic drinks specialists. Other brewery owners explored export options.

Seeking to sell their beer directly from their breweries in addition to the wider distribution channels of Systembolaget and on-trade, local beer producers are also hoping that “farm sales” will be permitted in Sweden moving forward, although they do not want this to replace their opportunities through the vast Systembolaget network.

Spendrups Bryggeri strengthens leadership in consolidated competitive landscape

The competitive landscape of beer in Sweden is fairly consolidated amongst the leading players, with Swedish family-owned Spendrups Bryggeri AB retaining its leadership in 2020 and gaining further total volume share from its closest rival Carlsberg Sverige AB. Spendrups Bryggeri continued to increase its sales through Systembolaget while recording a marginal decline in total volume sales due to its strength in the ontrade channel, with the latter experiencing significant drops in demand during the pandemic. The leader’s strength is linked to its convincing leadership of the largest category, domestic premium lager, through a range of brands including Mariestads, and Norrlands Guld with the latter gaining notable share in 2020. It also has a growing presence in imported premium lager through Krušovice for Heineken NV, which continued to gain share in 2020 in addition to recording double-digit total volume growth. However, Spendrups Bryggeri’s consumer loyalty is mainly supported by being local, family-owned and a growing focusing on sales of organic beer which continued to gain in popularity over the review period.

RECOVERY AND OPPORTUNITIES

Despite ongoing restrictions in early 2021, on-trade sales of beer set to strongly bounce back

While further restrictions introduced in 2021 to curb rising cases of the virus may continue to subdue a stronger recovery in the first half of the year for on-trade sales, the channel is still predicted to bounce back over the first part of the forecast period due to pent-up demand, despite some lingering price sensitivity. Therefore, on-trade sales of beer are predicted to return to pre-pandemic levels by 2022.

This will translate to a marginal decline for off-trade sales of beer in 2021 before it returns to steady but low growth over the forecast period, supported by the national trend for pre-drinks in the home before going out to socialise in bars or pubs. However, growing from a much lower sales base, on-trade will be the more dynamic performer overall. A greater move towards sustainability offers further potential for beer producers to explore various packaging options which is likely to see a further move away from glass bottles towards metal cans.

Strengthening consumer confidence will boost interest in craft beers and more expensive niche areas

As local consumers gradually regain their confidence and lingering price sensitivity wanes, they are likely to return to pre-pandemic trends in terms of being willing to try new and interesting craft beers in an effort to support local producers, although imported beer which offers new or unusual flavours is also likely to attract consumers. E-commerce, which gained further off-trade volume share in 2020, is likely to support the search for differentiation. Consumers looking to move away from lager will also support the further growth of dark beer such as ale, or stout, with more dynamic growth predicted through the on-trade channel, as consumers are more likely to indulge in, or experiment with, more expensive beer types when they are out socialising.

Health-conscious consumers set to return to non alcoholic beer

While experiencing declines in 2020, non alcoholic beer is expected to recover and record notable growth rates over the forecast period in both off-trade and on-trade channels, as consumers return to healthier lifestyles, a trend which will be particularly driven by the younger adult demographic. Non alcoholic beer will benefit from being deemed an alternative to soft drinks while healthier than regular beer given the absence of alcohol. Its low retail prices due to the absence of excise tax payable on non alcoholic beer will also appeal to consumers, who will likely remain price-sensitive heading into the forecast period following rising unemployment related to the pandemic and its impact on the country’s tourism industry.

CATEGORY BACKGROUND

Lager price band methodology

When deciding on price bands domestic beer brands sold through regular off-trade outlets such as ICA and Coop are assumed to be mid-priced. Examples of such brands are Mariestads, Carlsberg Lager and Heineken with no more than 3.5% abv. These do not cost more than SEK26.48/litre when bought in multipack formats.

Hence if the unit price of a brand is SEK26.50 or more it will be classified as premium. Most of the brands being sold through Systembolaget are classified as premium brands, since price increases with higher alcohol content and if not sold in multipacks. Some imported brands which are premium can be found in regular offtrade outlets, with no more than 3.5% ABV, due to their higher than SEK26.50/litre unit price even when sold in multipacks. Examples of these are Corona Extra (3.2% ABV), Budweiser (3.5% ABV) and Krušovice Imperial (3.5% ABV).

Premium: SEK>26.50 per litre

Mid-Priced: SEK 17.9-26.65 per litre

Economy: SEK<17.9