Craft Beer Import and Export Vital For Survival Through 2025

Craft Beer Export USA

“Craft Beer” is now an established feature in the global beer landscape. Growth continues to decelerate in the core US market, while the movement is still in its early stages in key emerging markets, such as China and Vietnam. In this way, microbrewers are looking to innovate and diversify due to increasing competition in mature beer markets. Flavours and styles remain a crucial point of differentiation, while shifting consumer trends provide a source of inspiration, but also bring challenges.

With the impact of the novel Coronavirus Covid-19, along with a rising shift in protectionism in many parts of the world, the future of craft beer, both domestically and indeed internationally will be centralized around distribution, particularly import and export distribution through the next 5 years.

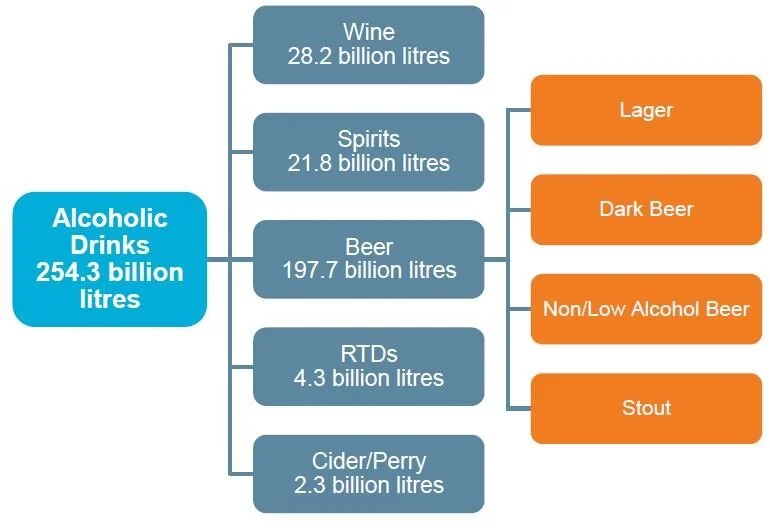

Global Alcohol Volume 2025

Here at Pacific Rim Distribution, we call ourselves ‘PACRIM’ as we focus on craft beer distribution in the Pacific Rim, with an acute focus on Asia. With a presence in 19 international markets, we have seen 5 key trends driving the market which point to the necessity for craft beer innovation, import, and export.

Definitions continue to evolve

“Independence” continues to gain ground as a key feature of craft. A number of small brewer organizations in different markets have released “seals” which allow brewers to highlight their craft credentials, with the term “independent” featuring prominently. In the US, the Brewers Association has dropped the “traditional” pillar of its craft requirements. This has extended all the way to Asia, with full conferences happening every year such as the South East Asia Brewery Conference (SEABrew).

What’s more, many markets are doubling down on the craft beer movement and are starting to change taxation laws which have historically favored local monopolies in ASEAN markets. Thailand remains restrictive, but countries like Indonesia, Vietnam and Taiwan are becoming more and more interesting to local Canadian craft brewers.

Divergence in a slowing US craft market

The deceleration of craft beer growth continues in the US. The Brewers Association reported just 4% growth in 2019. In this new environment, there will be a divergence in the market, with the very local microbrewers on one side and the larger craft brewers with national or regional distribution, such as Boston Beer Company, on the other.

This divergence has metastasized in the eyes of many craft beer drinkers - which have shunned prior craft brewing gems like Goose Island Brewing after being acquired by large corporations - and frankly, for good reason.

Brewers branching out

Competition in established craft markets is intensifying as growth slows, while new breweries continue to open. Many microbrewers are diversifying their offers by expanding into spirits, kombucha and, especially, alcoholic seltzers. The rise of White Claw Hard Seltzer in the United States, and brands like Muddlers Craft Cocktails and Nude Vodka Soda in Canada speak to the need for brewers to diversify their portfolios, as sour beers just wont cut it anymore.

To successfully incorporate new product types into their portfolios, brewers need to ensure there is a close fit with their original beer brands in terms of transparency, branding and quality of ingredients.

Urbanization drives emerging market opportunities

A growing middle class and rising urbanization are helping to drive the growth of craft in Vietnam and China. Microbrewers are opening across the world, focused in the early stages on metropolitan centers, but often quickly expanding beyond the major cities. International brewers are looking to capitalize on this growth through acquisitions as mentioned previously.

As brewers look to expand their footprint, craft beer import and craft beer export opportunities will become ongoing sources for growth for big and large brewers alike. With depressed local markets, unique product portfolios and favorable cost mechanics, exporting products to avoid local taxation laws only makes sense. The international growth of local mainstay craft brewers like Parallel 49 Brewing Company from Canada, Stone Brewing from the United States, and Brewdog from Scotland speaks to the value of export and emerging market opportunities to local brewery business models.

Importance of adaptation

The development of craft is shaped by the issues and trends affecting the wider beer industry. Microbrewers are tapping into rising consumer moderation, and are taking steps to enhance their sustainability. Such adaptation will continue to prove crucial as fashions change and regulations evolve those regarding cannabis, for example.

Moreover, adaptation to international markets will continue to benefit brewers looking to export through 2025. We’re seeing international brewers collaborate with local brewers to brew with local ingredients for the markets they serve. Examples like Red Racer Lucky Pig by Central City Brewing in Canada, and Hong Kong Beer Co in Hong Kong demonstrates the power of adaptation in market

Red Racer Lucky Pig.jpg