PACRIM's Summary for Beer in Taiwan

Craft beer taiwan.jpg

HEADLINES

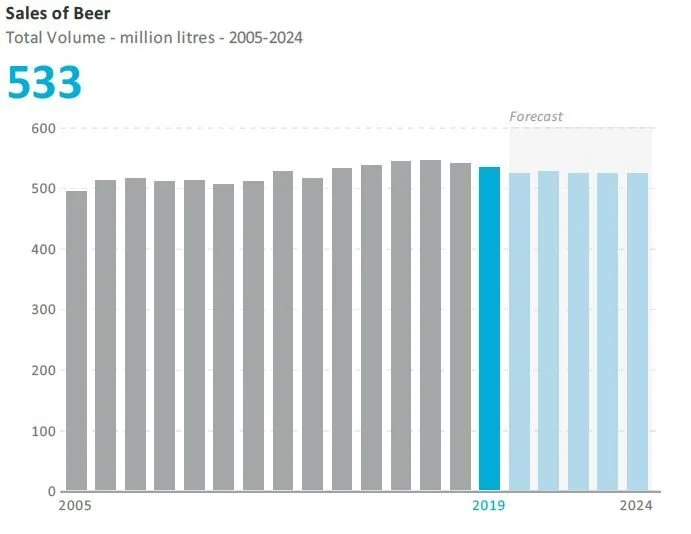

Despite Taiwan’s lack of official lockdown, COVID-19 impacts on-trade demand for beer, with shift towards home consumption

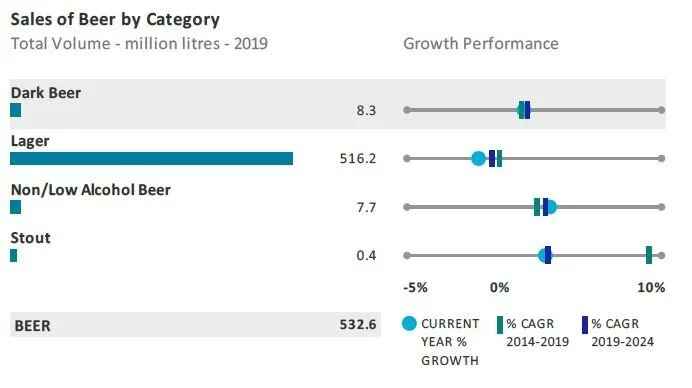

Beer sees total volume growth of -1% in 2019 to stand at 533 million litres

Higher value, more premium products such as craft beers appeal to consumers in 2019

Imported premium lager sees healthiest performance in 2019, with total volume growth of 5% to stand at 136 million litres

Beer category’s average unit price sees 3% current terms increase in 2019 Taiwan Tobacco & Liquor Corp remains dominant on 55% in 2019, but sees volume share eroded as smaller players make gains

Beer set to see -0.4% total volume CAGR over forecast period to stand at 523 million litres in 2024

PACRIM Taiwan2.JPG

PRE-COVID-19 PERFORMANCE

Beers with upmarket or healthier positioning attract consumers

Low- or non-alcoholic beer became increasingly popular in Taiwan in recent years,especially among the younger generation. Major players all see the huge potential inproducts with a lower ABV, such as the new non-alcohol beer launched in 2019 by Taiwan Tobacco & Liquor Corp. As the leader of Taiwan’s beer category, it also noticed the change in consumer preference. The reason this new product was more acceptable to consumers is that its taste is similar that of normal beer. Moreover, stricter rules regarding drink driving have also motivated consumers to change their preferences.

Most importantly, lower ABV products are positioned as healthier options, as they contain fewer calories than standard beers. However, some young adult drinkers still demonstrate a preference for high ABV products, which they perceive as conveying an “adult” image.

Taiwan’s craft beer category also saw huge growth in demand at the end of the review period. Seeking to tap into the trend towards such products, King Car Food Industrial Co Ltd, the well-known local player in Kavalan whisky, started its business launching craft

beer brand Buckskin from 2018. It utilised local materials to provide diverse and authentic flavours through different chains to attract more consumers. The company’s efforts resulted in a high level of positive feedback and increased awareness, not only due to consistent quality, but also its channel strategy, selling through its own bistros or karaoke establishments. A great proportion of craft beer awareness in Taiwan is attributed to the company’s efforts to educate consumers and make these products highly appealing.

While lager accounted for the majority of beer consumption in Taiwan, awareness of ale is expected to rise. This is due to the popularity of the craft concept, with many consumers viewing lager as lacking sophistication and being consumed by the masses. With the impact from new Korean ale, which is available in Taiwan via the largest convenience store chain, 7-Eleven, the growth of off-trade ale increased in 2019. Many consumers in Taiwan are fans of Korean alcohol products, and these players were leveraging on this preference at the end of the review period. In addition, a revamped Starbucks in Taiwan was set to sell pink ale infused with passion tea, aimed at female consumers. Although there were many innovations in the category in recent times, declining sales volume due to stricter execution of the country’s drink-driving policies continued to limit growth potential.

PACRIM Taiwan1.JPG

Players target specific consumer groups with carefully positioned offerings

Taiwan Ale Brewery tried to target female consumers by launching different flavours combined with local materials in products with an ABV of less than 4%. This is a craft beer that can offer consumers a sense of fresh, distinct and back to basics ingredients. The slightly sour flavour is attributed to the fruits used, such as litchi and mango, among others, which are attractive to female and younger consumers. In addition, Le Ble D’or F&B Co Ltd, a popular bistro chain in Taiwan famous for its Sunmai craft beer, noticed a reduced preference for beer during the fall and winter seasons. Therefore, in November 2019 it launched two ale flavours: longan and cinnamon. These are recognised as warming ingredients in Taiwanese culture, and the aim was to boost demand for ale during cooler weather.

Beer sold though convenience stores faced fierce competition in 2019, as this represents a significant channel for off-trade volume consumption. During particular holidays or activities, players in the convenience stores environment would introduce popular and innovative products globally to attract consumers’ attention. Not only did local craft beers gain a high level of awareness among consumers, but exotic products with special marketing points, such as origins, flavours, high ABV, etc., also attracted considerable consumer attention. 7-Eleven, as the leading player in the convenience stores channel in Taiwan, implements international beer day on an annual basis to promote beer during the summer. However, competition with RTDs and ciders is strong in convenience stores, due to the availability of all of these products in the same area within stores. On the other hand, an increasing number of beer products with a high percentage of juice content were evident in hypermarkets at the end of the review period, seeking to meet the demands of those wishing to drink products perceived as healthier. Consumers who visit hypermarkets tend to purchase larger amounts, and products with a lower ABV, and containing healthier ingredients, can encourage increased purchase volumes.

Foodservice establishments increasingly important to promotion of craft beers

There was a booming trend in the bistro business in Taiwan at the end of the review period, due to fewer people wishing to cook at home, and demonstrating increasing interest in dining experiences. Combined with growing awareness and demand in craft beer, these foodservice channels became important promoters of different types of craft beer products in 2019. Consumers tended to choose those products that represented their characteristics or cuisine preferences. For example, Buckskin Beer House and Sunmai Bar, both named after their craft beer brands, had already become flagship stores for players in this industry to follow.

2020 AND BEYOND

COVID-19 impact

On-trade volume sales of beer are expected to fall by 13% in 2020 in light of the impact of COVID-19. This compares to an expected 2% growth forecast for 2020 during research conducted in May 2019, ie before the spread of COVID-19. Off-trade volume sales of beer, meanwhile, are expected to increase by 3% in 2020 due to COVID-19’s impact. This compared with the increase of 0.1% forecast for 2020 during our research conducted in May 2019.

The impact for beer as a result of COVID-19 is mostly due to the reduced ability to have gatherings in establishments such as bars and restaurants, as well as at home. Some ontrade channels have been forced to close due to lack of visitors, however, this may be temporary, as unlike other countries Taiwan has not been subject to major lockdowns.

Affected products within beer

Home seclusion has had a slightly negative impact on bitters, both domestic and import mid-priced lagers, imported premium lager, and stout. This has resulted in a corresponding slightly positive impact in terms of channel shifts for these products. This is due to consumers’ reduced ability to make purchases of alcoholic drinks in ontrade establishments. As a result they have somewhat increased purchases in off-trade outlets for home consumption.

Recovery and opportunities

Low-alcohol and non-alcoholic beers have potential for growth, driven by the health and wellness trend. New launches are also expected in this category. The effects of the health trend will be exacerbated by the increased awareness of health issues arising from the COVID-19 pandemic, and the relationship between the health of the immune system and obesity on the severity of the disease. Health-conscious consumers are more aware than ever of the effects of the frequent and excessive alcohol consumption. Furthermore, such products appeal to those who participate in sporting activities, and also to pregnant women. Low-alcohol or non-alcoholic beer could therefore satisfy a number of demands that were not previously considered in the beer industry.

One of the fastest developing areas in Taiwan pre-COVID-19 was craft beer. Such products captured the imagination of consumers through a variety of new and interesting introductions. Domestic craft beer was performing well, with local consumers drawn towards locally-brewed products, which appealed to their patriotism as they could support small local businesses. Craft beer enthusiasts appreciated the offer of exclusive limited edition/release products, which were becoming available through convenience stores and supermarkets. Given the potential craft beer demonstrated prior to COVID-19, it seems likely such products will see further development over the forecast period as economic conditions improve. However, they may appeal to a smaller consumer base than previously, as many people experience constrained spending power in the post-pandemic environment.

CATEGORY BACKGROUND

Lager price band methodology

Premium products in Taiwan’s lager category include Budweiser, Heineken and Asahi from Asahi & Mercuries Co Ltd. These are usually imported brands that are well-known and offer consistent quality. Mid-priced products are the Taiwan brand from Taiwan Tobacco & Liquor Corp, Tsingtao from Taiwan Tsing Brewery Corp, and Kirin Ichiban from Taiwan Kirin Beer. These are more local brands that serve demand when people seek greater volumes during gatherings, or have more budgetary concerns. Such products are more targeted towards younger consumers than premium brands. There is no economy lager in Taiwan.

Taiwanese consumers are among the most price-sensitive in the world. Still, price is the most important factor when it comes to lager, since on most occasions people seek large amounts. On the other hand, even though craft beer was gaining popularity pre- COVID-19, craft beers consumers would still opt for cheaper options if the difference in quality was limited. Local brands usually have a lower price advantage. Buckskin is popular with diverse flavours and channel coverage, while offering great quality at an affordable price. So does Taihu Brewery, with lots of its brands positioned as traditional Taiwan flavours. They are appreciated by local consumers, offering great quality craft beer with well-designed packaging, and different discounts implemented at different times. However, imported brands from Korea, such as Jeju and Lotte with its Hippi designed packaging and Korean branding, would nonetheless appeal to those seeking Korean products despite their higher price.

Premium – TWD $192 – 666 per litre

Mid-Priced – TWD $89 – 109 per litre

Economy – Less than TWD $89 per litre