For Craft Beer in China - Premium Focus Remains Key

Craft beer is growing on a global scale, and despite the pandemic and a shift towards trading down, for craft beer in china, a focus on premium remains key.

Covid-19 has impacted the global craft beer movement in 2020, yet despite casualties, craft producers can (and will) survive this crisis. Micro brewers and distillers with a premium focus may struggle locally in North America as a result of economic pressures, but there is still a need for alternative brands with social prestige. Placing an even greater emphasis on specific locations, sustainability and the traceability of ingredients will help craft to justify its price point. Long term, moderation trends bring opportunities.

In late 2020, China has begun showing signs of economic recovery from the pandemic, one of the first major economies to do so, although the strength of the recovery remains somewhat uncertain.

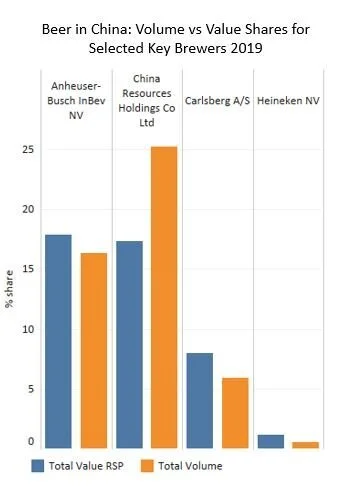

Premium lager is still forecast to see the fastest lager growth in China over 2019-2024. AB InBev leads premium lager in China with a dominant 40% volume share. Its lead has been gradually declining as competition intensifies.

Canadian Craft Beer Export in China.JPG

The economy lager segment contributes the highest share of Carlsberg’s volumes in China, accounting for 48% of its beer sales in 2019; however, this marked quite a reduction from 85% in 2014. Carlsberg holds a reasonable share of premium lager volumes, ranking second in the category with 18% in 2019.

Although Heineken does not hold a leading position in China, its business is very much orientated to the higher end of the spectrum. The opposite is true for market leader China Resources. In 2018, Heineken took a 40% stake in China Resources. The transaction boosted China Resources’s ability to compete at the upper end of beer, and provided Heineken with access to a vastly improved distribution network through which to expand the footprint of its premium beers.

Looking at the craft segment in China, consumer preference is still there for prestige craft brands, and customers are willing to pay for it, however beer exported to China need to be unique, customized, and unequivocally premium. Wax dipped, bottle conditioned beers are doing incredibly well in 2020, and is forecasted triple digit growth in the niche category.

While local players are competing with each other and a competitive north american government supported monopolies, look to China for Canadian craft beer export and sales.