PACRIM's GUIDE TO CRAFT BEER IN KOREA

KEY DATA FINDINGS

Consumers switch to home drinking in 2020 due to COVID-19

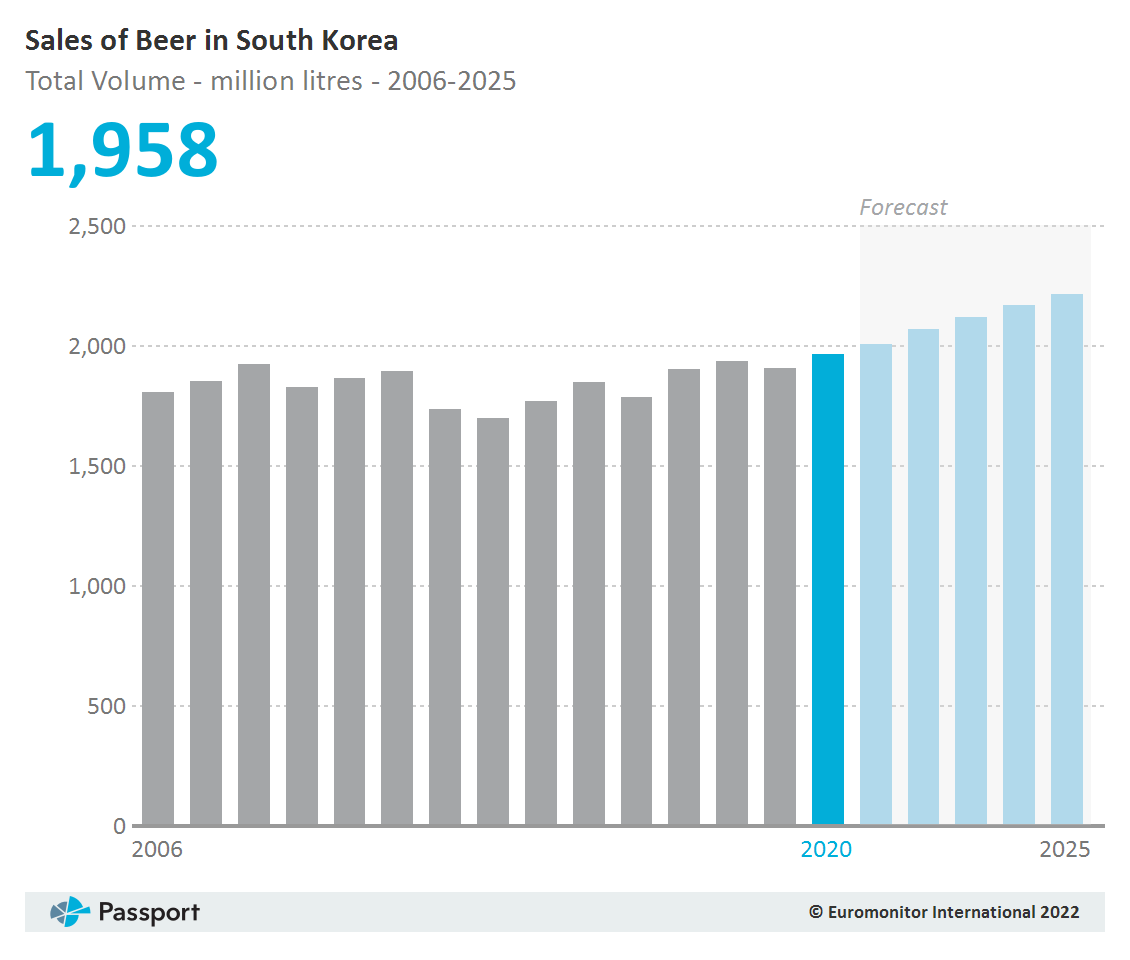

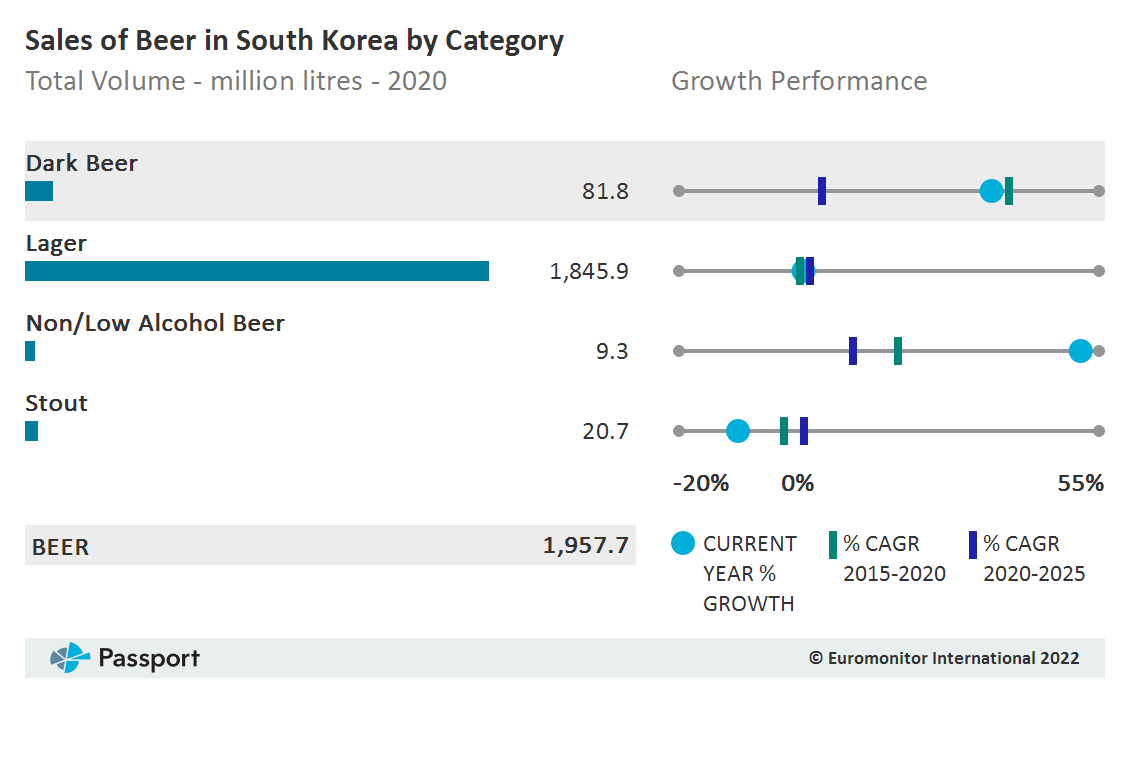

Sales see total volume growth of 3% in 2020 to reach 2.0 billion litres

Non alcoholic beer is the most dynamic category in 2020 with total volume growth of 53%

Prices decline slightly in off-trade and on-trade terms in 2020

Oriental Brewery Co Ltd retains its dominance despite seeing its total volume share drop to 51% in 2020

Over the forecast period, beer is projected to increase at a 2% total volume CAGR to reach 2.2 billion litres in 2025

2020 IMPACT

Domestic beer brands thrive as consumers switch to home drinking

Beer registered a polarised performance following the outbreak of COVID-19, with on-trade sales plummeting while off-trade sales saw double-digit growth in volume terms. After the introduction of a lockdown, South Korea saw a growing trend towards 'Home sool', which refers to drinking alone at home, with consumers unable to drink in on-trade establishments.

Domestic beer brands registered a good performance thanks to the change in the liquor tax system and also the declining popularity of imported beer. The net effect of the new tax system was a reduction in costs for local producers, thereby making their products more affordable and thus more attractive. According to the Ministry of Strategy and Finance, the changes have resulted in the total tax on domestic beer decreasing by about 20% per litre, although the exact amount of tax varies on the type of packaging. For example, until 2019, domestic beer packed in metal beverage cans attracted liquor tax of around KRW1,150 per litre, which has now been reduced to KRW830 per litre.

Japanese beer in particular experienced another big decline in 2020 as the boycott on Japanese goods, which started in 2019, continued. This is due to the recent political conflict that has emerged between South Korea and Japan, which has turned many consumers off Japanese beer such as Asahi and Kirin Ichiban Shibori. Some Koreans have reported feeling guilty for buying Japanese beer, with some retail outlets and foodservice establishments having even removed Japanese brands from their shelves. Meanwhile, another top selling imported beer, Tstingtao, suffered heavy losses due to its Chinese origin, with consumers associating Chinese goods with COVID 19.

Premium local beer brands filled the space left by imported beer, selling particularly well at convenience stores. Previously, local craft beer was mainly sold at on-trade premises but in 2020, craft beer breweries expanded their distribution to off-trade retailers, with Jeju Beer being a good example. Being named after a local island in South Korea, the company’s Jeju Wit Ale appealed to consumers as a substitute for Japanese beer. Increased price competitiveness supported by the revised liquor law was another driver behind its dynamic growth in 2020.

Another good year for Hite Jinro Co Ltd as Terra takes South Korea by storm

Whilst Oriental Brewery retained its dominant position in 2020, the second ranked player Hite Jinro took some of its share thanks in part to the positive performance of its domestic mid-price beer brand Terra which attracted sales from the younger generation. Launched in 2019, the new brand has successfully created a young and fresh image with a distinctive bottle colour, while also benefiting from the use of popular celebrities in its marketing. The company's economy lager brand Filite also retained its dominant position, albeit with Oriental Brewery's Filgood brand being the only other brand present in the category. Oriental Brewery, meanwhile, had a hard time with its Cass brand losing share due to the success of Terra. Another of Oriental Brewery's major beer brands is Budweiser, but the company chose to discontinue the brand’s 500ml bottle packaging, which had been launched to win back share from Terra but which failed to attract consumers.

Third-ranked Lotte Chilsung Beverage Co Ltd, had an even worse year in 2020. In addition to the negative impact of COVID-19 and restrictions on on-trade sales, Lotte also suffered from the negative impact of the boycott on Japanese goods (Lotte runs businesses both in Korea and Japan). Awareness of Lotte's flagship brands Kloud and Fitz is also much weaker compared to Hite Jinro's Terra and Oriental Brewery's Cass.

Non alcoholic beer benefits from increased focus on health and wellness

Non alcoholic beer was the most dynamic category in 2020. Beer manufacturers have caught on well to the increasing interest in health and wellness, especially since COVID-19, and introduced several new non alcoholic beer brands into the market at the end of the review period. The local market leader Oriental Brewery launched Cass Zero in 2020, while imported beer player Qingdao launched a non alcoholic beer extension in 2019. Another driver behind the growth of non alcoholic beer in 2020 has been that, unlike standard beer and other alcoholic drinks, these products are available online. Many consumers were reluctant to visit store-based retailers as social distancing measures tightened, with this benefiting online sales of non alcoholic beer. Furthermore, non alcoholic beer brands used active online marketing to raise awareness of these new products among consumers. South Korea bans the sale of alcoholic beverages online, but non alcoholic beer is an exception.

The consumer base for non alcoholic beer is expanding, embracing even beer lovers who are more sensitive to tastes. Whilst responsible indulgence will be at the core of the alcoholic drinks industry, more beer lovers who want to drink beer without constraints on location, health issues, or drunk driving are expected to become the main contributor to the volume growth of non alcoholic beer. Previously, there was a limited consumer base for non alcoholic beer in South Korea, being limited to small groups such as pregnant women or patients, while beer lovers generally avoided non alcoholic beer due to its lack of taste. However, the taste has improved significantly in line with the development of non alcoholic beer manufacturing technology in recent years, with it now tasting a lot like a real beer.

RECOVERY AND OPPORTUNITIES

Domestic beer set to remain at the heart of growth

On-trade sales of beer are likely to remain deflated in 2021 as the country continues to try and manage COVID-19 and the rolling out of its vaccination programme. For the retail channel, domestic lager is expected to continue growing, with the strong home sool trend supported by the increasing number of beer SKUs. However, demand for imported lager will likely continue to fall with trendier craft beer expected to take its place. Imported lager used to be a trendy option among younger consumers, with it being competitively priced under the previous tax system; however, the new tax system has significantly lowered the price of craft beer. More domestic beer brands will likely also join the four cans for KRW10,000 campaign – a legendary marketing strategy deployed by convenience stores which led to sales of imported beer rocketing after it was introduced. Economy lager is expected to see more modest growth over the forecast period after dynamic growth towards the end of the review period, while non alcoholic beer is expected to gain traction with more consumers, with COVID-19 having pushed consumers to focus on reducing their alcohol intake, even after the lockdown was lifted.

Craft beer set to benefit from new alcohol regulation

Craft beer is expected to see further expansion over the forecast period as consignment production such as original equipment manufacturer (OEM) will be allowed, in line with the measures to improve alcohol regulation which were announced by Ministry of Strategy and Finance of Korea. This change in regulation would help both existing big breweries and small craft brewers. Due to the sudden hike in craft beer's popularity, many small breweries are facing difficulties in meeting the demand. Due to their scale of operations, however, it would be risky to build a new plant due to the added financial burden. Instead, big manufacturers such as Lotte could produce OEM craft beer using its already existing huge capacity. Many popular restaurant franchises such as BBQ and Kyochon Chicken also plan to launch OEM craft beer brands in 2021, which would help propel the growth of local craft beer in South Korea.

The off-trade is expected to benefit from new product development as competition intensifies

As the impact of COVID-19 continues to be felt in 2021, beer manufacturers are expected to focus more on product development for retail products with improved packaging. Innovative packaging such as sleek cans (slim type 330ml aluminium cans), transparent glass bottles, or small PET bottles will likely become popular. The focus is likely to be on convenience, design and sustainability. This should include packaging which is easy to carry – lightweight and not easy to break – and which is also more eye-catching. The latter point is particularly important due to the ever-growing range of options on retailers’ shelves, unlike on-trade premises where there are usually only three or four brands available. In terms of sustainability, transparent bottles improve the glass recycling rate, while these products also allow the consumer to see the actual colour of the beer. Convenience stores will likely be seen as the most popular places to showcase new beer brands, and there is expected to be more collaborations with beer manufacturers and convenience store chains, with special promotions and discounts likely to be an increasingly common feature.

CATEGORY BACKGROUND

Lager price band methodology

Examples of brands within the different price bands:

Premium: Heineken

Mid-priced: Cass

Economy: Filite

Premium Above KRW4,700 for imported lager/above KRW3,800 for domestic lager

Mid-priced KRW2,800-KRW3,800

Economy Below KRW2,800