The Future of Beer in Canada in 2022

WHAT YOU NEED TO KNOW

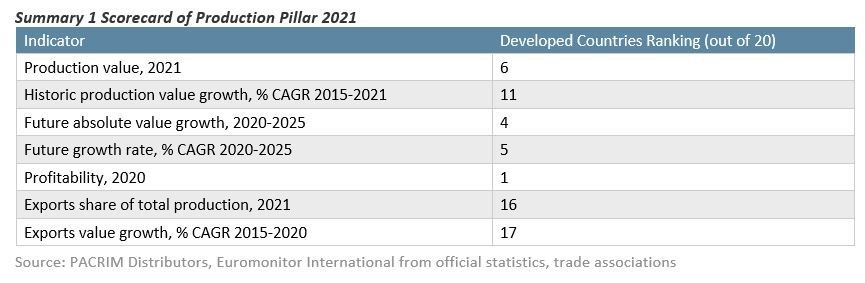

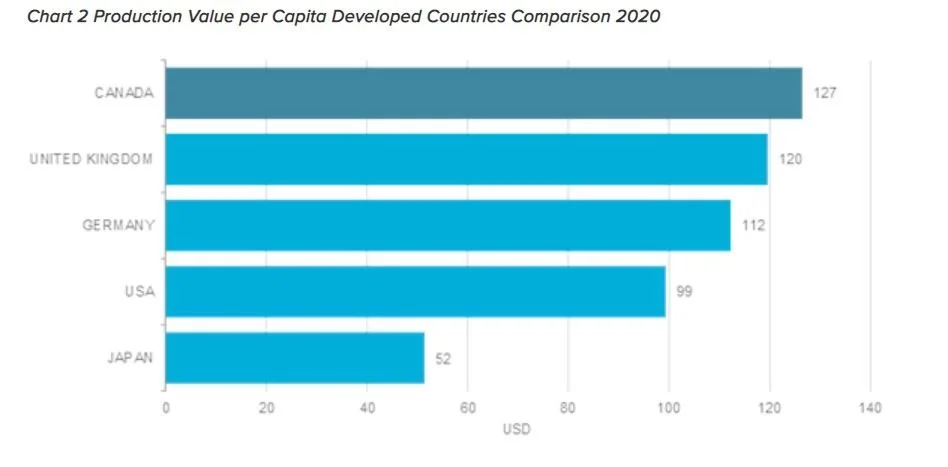

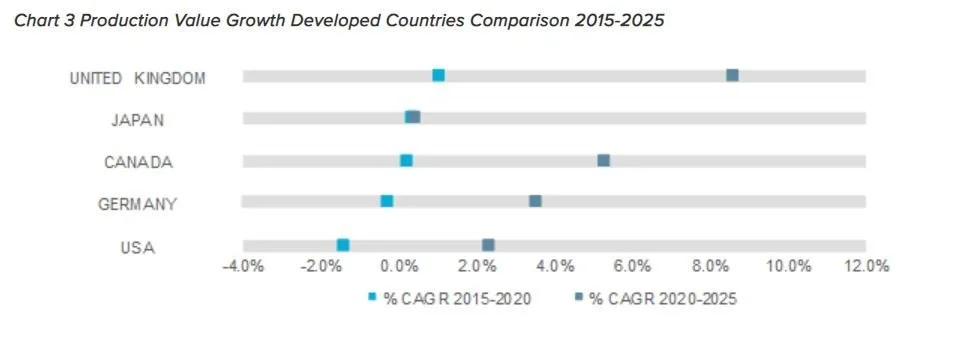

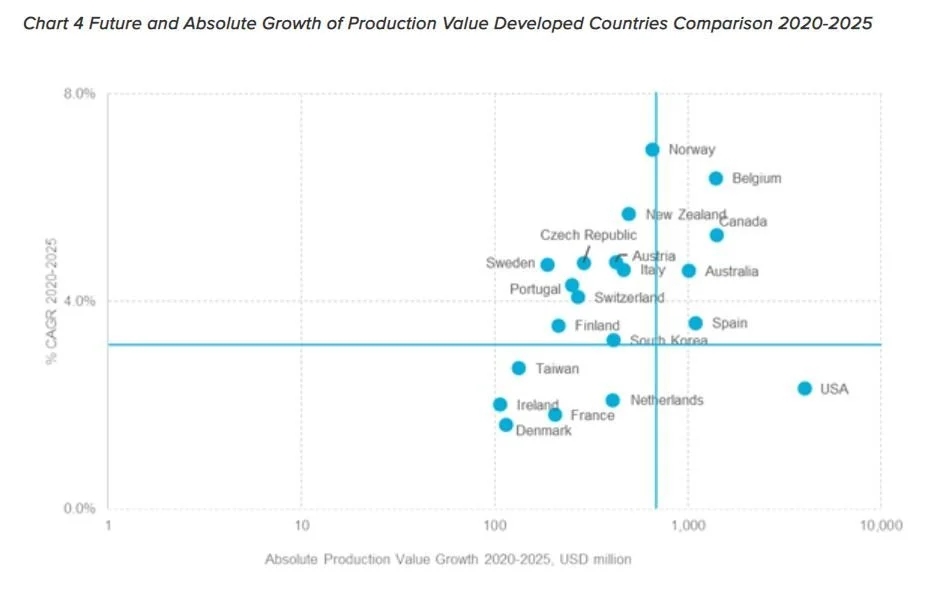

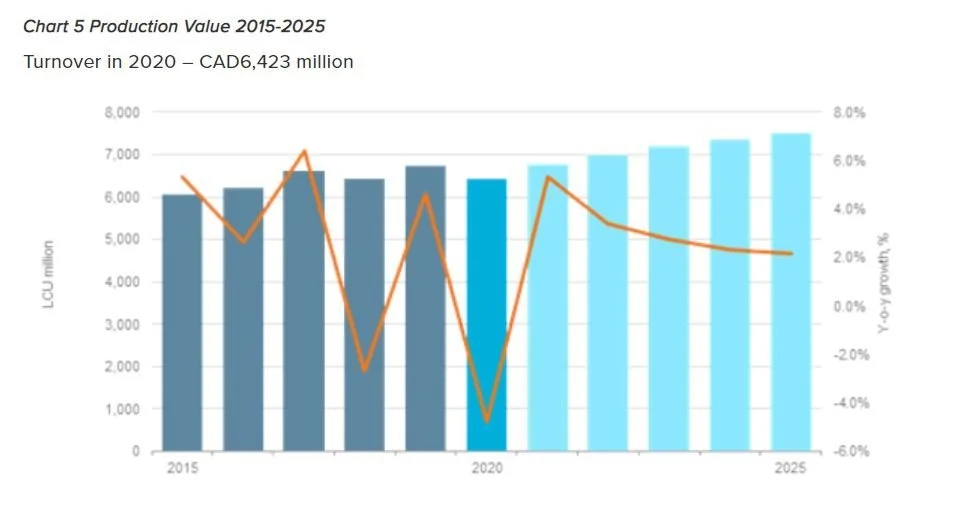

Canada’s beer production value declined by 5.8% in 2021, making Canada the sixth largest country across the top 20 developed countries. The industry’s production value is forecast to grow at a CAGR of 5.3% over 2020-2025 and fully recover from the COVID-19 pandemic in 2021. This industry report provides comprehensive data on production, consumption, imports, exports, the industry’s costs, the industry’s profitability and the competitive landscape. Key indicators are benchmarked against other regional and developed countries.

HEADLINES

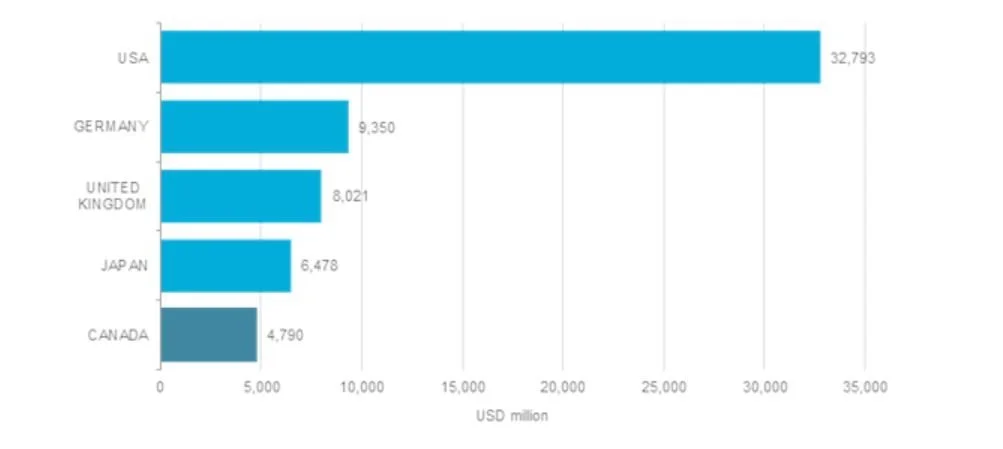

With production value of USD4.8 billion, Canada accounts for 12.7% of the North America total in 2021

The industry’s profitability increases and stands at 32.5% of production value in 2020, the highest across the top 20 developed countries

The costs of the industry decrease by 6% in 2021, largely driven by declining B2B costs

The total number of companies decreases in 2020, to 1,316 units

The industry is concentrated, with the top five companies generating 58.1% of total production value in 2021

Molson Coors Canada is the largest company in Canada, generating 40.1% of the industry’s total production value in 2021

Canada has the fifth largest market size for beer across the top 20 developed countries, with demand reaching USD12.3 billion in 2021

Households drive market demand, with household spending representing 93.3% of total demand in 2021

The market is dominated by domestic suppliers, as imports account for 7.8% of total market size in 2021

INDUSTRY OVERVIEW

Beer industry turnover in Canada ranks sixth across the top 20 developed countries. The industry’s turnover is forecast to recover fully from the COVID-19 pandemic in 2021 and is forecast to rank sixth in 2025. In terms of absolute industry turnover growth, Canada is forecast to rank fourth across the top 20 developed countries. This indicates stronger B2B demand potential from the beer industry in Canada in comparison to other developed countries.

The beer industry is mainly dependent on demand growth in the domestic markets, as exports accounted for 2.6% of total production output in 2021. Canada ranks 16th across the top 20 developed countries in terms of exports share.

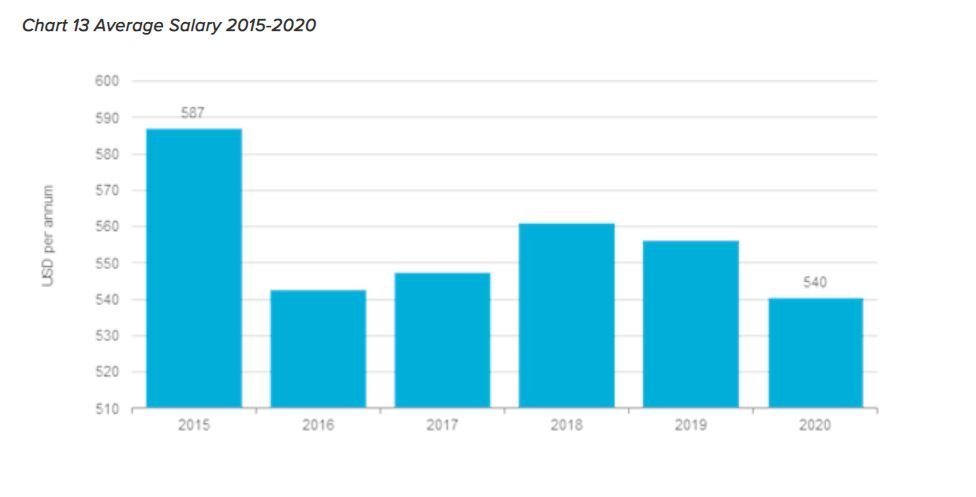

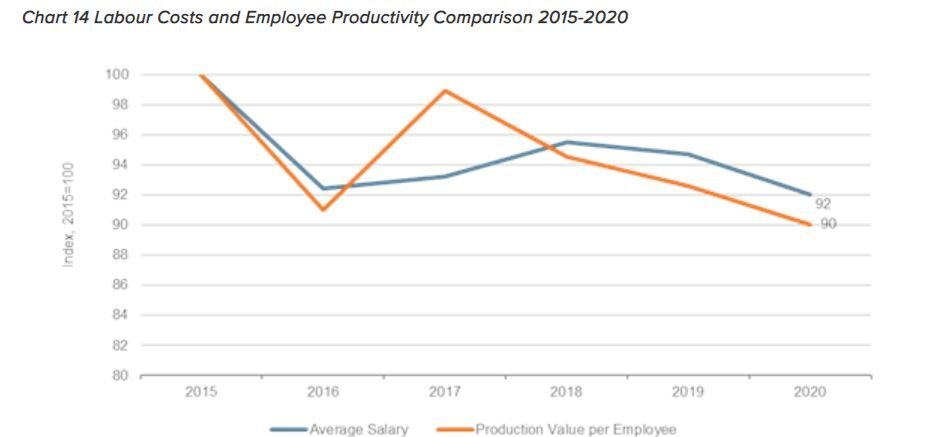

Industry costs decreased by 6% in 2021. The change was largely impacted by B2B costs, which represented 71.2% of total industry expenditure in 2020. Productivity of the industry decreased over the year, as turnover per employee declined by 2.8%, and was larger than labour costs growth.

The industry’s profitability increased in 2021, and reached 32.5%. Canada ranks first across the top 20 developed countries in terms of the beer industry’s profitability.

The total number of companies operating in the industry declined in 2021, to 1,316 companies. The industry can be considered concentrated, as the five largest companies accounted for 58.1% of production value in 2020. The industry’s concentration increased over the year. Molson Coors Canada remained the leading company in Canada’s beer industry, and accounted for 40.1% of production value in 2020.

PRODUCTION SCORECARD

The Production Scorecard is a benchmarking tool to evaluate the industry’s performance within the region. The scorecard considers indicators in seven key pillars that are at the core of the industry’s competitiveness. The scorecard is built by ranking countries in the regional context and helps to quickly identify country-specific opportunities.

The production value indicator helps to evaluate the industry’s size, supply chain network and B2B demand. Higher production value levels indicate greater potential B2B demand from the industry and a stronger supply network, which supports production.

Historic production value growth indicates the industry’s average annual production value growth over the period 2015-2020. The historic growth rate indicates whether the industry is mature or in the developing stage.

Future absolute value growth indicates the industry’s absolute production value growth in nominal terms over the period 2020-2025. High future absolute value growth indicates expanding production output of the industry and increasing B2B demand potential from the industry.

The future growth rate indicates the industry’s average annual production value growth over the period 2020-2025. The indicator helps to evaluate the industry’s future growth potential. A high average future growth rate indicates that the industry is in the development stage, with untapped B2B demand potential from the industry.

Profitability indicates the industry’s profits relative to total production value in 2021. The indicator helps to evaluate the industry’s financial stability, cost base and regional competitiveness. High profitability indicates a strong financial position for the industry, lower operating costs in the country and the industry’s competitive advantage over rival industry in other countries.

Exports share of total production indicates the industry’s export value relative to total production value in 2021. The indicator helps to evaluate the industry’s competitiveness in the global market and the diversification of sales channels. A high exports share indicates that the industry is competitive globally and has a diversified sales network.

Exports value growth indicates the industry’s average annual exports value growth over the period 2015-2021. The indicator helps to evaluate the industry’s competitiveness in the global market. High average growth in exports indicates that the industry remains competitive in the global market and/or has gained greater market share in the global market.

MARKET OVERVIEW

The beer market in Canada ranks fifth across the top 20 developed countries. In terms of absolute market size growth, Canada ranks 14th across the top 20 developed countries. The beer market in Canada was highly affected by the outbreak of COVID-19, as market size contracted by 4.8% in 2020, to reach USD12.3 billion.

Demand for beer is largely driven by household demand, which generated 93.3% of total demand in 2020. In nominal terms, household demand for beer decreased by 4.4% in 2020.

The beer market in Canada is dominated by domestic companies, as imports represented 7.8% of the total market size in 2020. The share of domestic companies declined from 8.4% in 2015.

CONSUMPTION SCORECARD

The Consumption Scorecard is a benchmarking tool to evaluate the market’s performance within the region. The scorecard considers indicators in five key pillars that are at the core of the market’s competitiveness. The scorecard is built by ranking countries in the regional context and helps to quickly identify country-specific opportunities.

Market size value indicates the total demand potential for specific goods or services. Higher market size indicates higher demand potential from households, B2B and government buyers within the country.

Market size absolute value growth indicates absolute demand potential growth in nominal terms over the period 2015-2020. High absolute demand growth indicates expanding domestic demand for specific goods or services.

Market size historic growth rate indicates the market’s average annual value growth over the period 2015-2020. A high average market growth rate indicates that the market is in development stage with untapped future demand potential for specific goods or services.

Imports share in total market indicates import value relative to total market size in 2020. The indicator helps to evaluate demand and sales potential of foreign goods. A high import share indicates high demand potential and sales potential for foreign goods in the country.

Imports value growth indicates average annual imports value growth over the period 2015-2020. The indicator helps to evaluate demand and sales potential of foreign goods. High average growth of imports indicates that the market remains open to foreign goods, and total sales potential is expanding.