PACRIM'S SUMMARY FOR CRAFT BEER IN PORTUGAL

KEY DATA FINDINGS

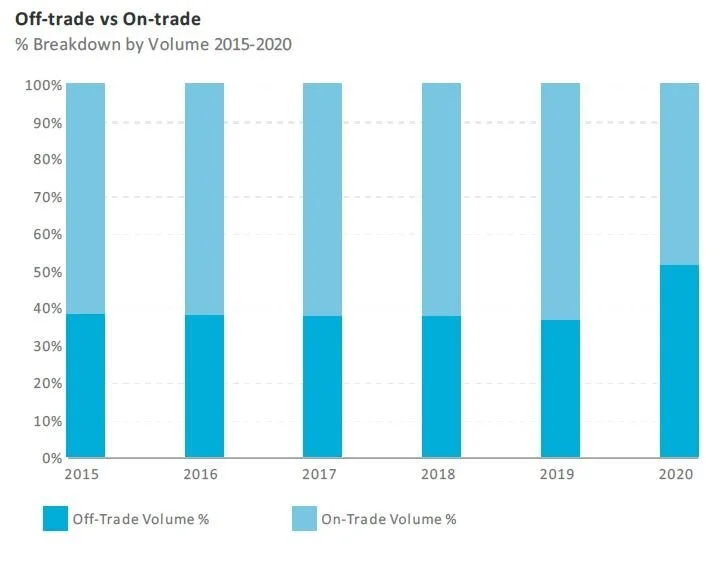

Despite strong growth in the off-trade channel, on-trade sales are severely impacted by the closure of on-trade establishments, the dramatic fall of tourism and decline in disposable income in 2020 due to COVID-19, driving total volume sales down

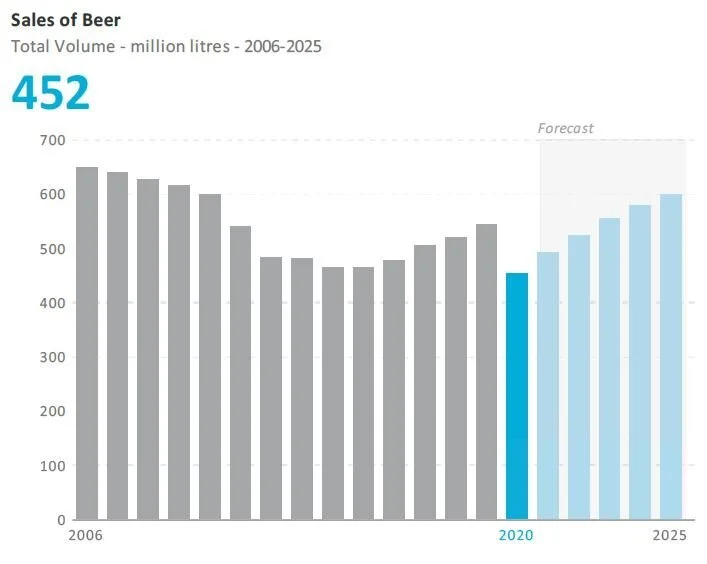

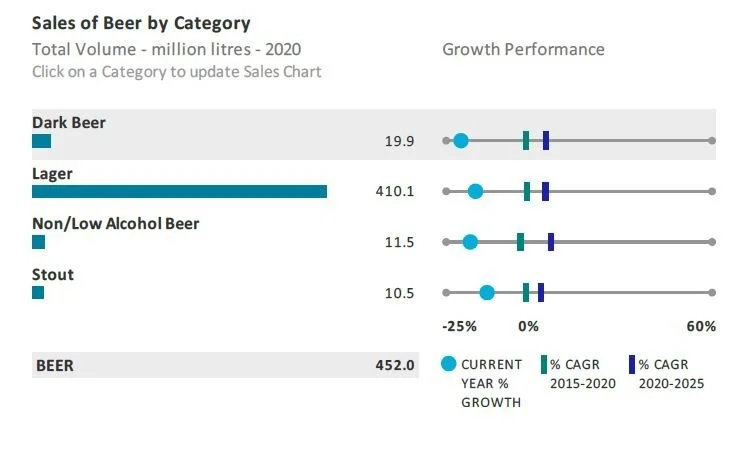

Total beer volume sales contract by 17% in 2020 to reach 452 million litres

Imported economy lager registers the highest total volume growth of 29% in 2020 to reach 9 million litres

The total average unit price increases by 13% in 2020

Super Bock Group SGPS SA leads the beer category in 2020 with a 44% volume share

Beer is set to register a 6% total volume CAGR over the forecast period to reach 596 million litres in 2025

Portugal Beer Forecast 2021

COVID IMPACT

Steep slowdown for beer due to the closure of the off trade during the height of the pandemic

The on-trade is generally a very important channel for beer and one which offers the most added value. It was also the channel to have suffered the most from the global pandemic witnessing a steep contraction in volume sales. While home consumption grew during lockdown and home seclusion, this was not able to compensate for the steep loss via the on-trade. While consumption did rise during the warm summer months helping to mitigate some of the losses, low tourism inflows, a ban on gatherings, music festivals and other popular social gatherings represented further lost opportunities to boost sales. In the off-trade, promotional activity remained high with price gaining even greater relevance since the loss of purchasing power and considerable economic uncertainty created by the pandemic. Moreover, with the majority of sales being carried out via the off-trade, the economy segment recorded growth in 2020.

Uplift for private label due to growth in grocery retailing and as consumers tighten their belts

Private label represents a high share of off-trade sales, therefore growth in this channel in 2020 stimulated in part by the closure of the on-trade was highly positive for the performance of economy lager. Following overall category trends, private label evolved over the years not only in line with consumer demand for cheaper products but also because the private label offering continued to expand. This expansion continued into 2020 when Lidl, in partnership with Praxis, released Tuga by Praxis craft beer. Private label also continued to gain share as retailing chains such as Mercadona and Aldi continued to invest heavily in new outlet openings, which increased the shelf presence of these products.

Super Bock Group and SCC Sociedade Central de Cervejas E Bebidas SA retain their duopoly while craft beer boosts penetration via the off trade and new products are launched

The category maintains a duopoly characterised by Super Bock Group and SCC - Sociedade Central de Cervejas e Bebidas SA. These companies present relatively similar strategies, withSuper Bock maintaining the lead in 2020, thanks to its greater dynamism in the off-trade channel.

Craft beer, despite its low penetration in the country, is important as it has brought innovation and sophistication to the beer category in recent years. Craft beer is highly dependent on the on-trade channel and tourism industry, the decimation of which in 2020 resulted in a significant sales decline. Moreover, entry to the off-trade channel is difficult and only a few craft beer labels such as Nortada or Sovina, have been able to secure a presence via this channel.

Several new product developments continued to be launched in 2020 despite the negative economic environment. Spanish brands increased their visibility in a category characterised by domestic manufacturers. In 2020 San Miguel, Mahou and Alhambra beers entered the off-trade in Portugal, after the Spanish Mahou San Miguel entered an exclusive distribution agreement with JMD for the national off-trade market at the end of 2020.

Portugal sales of beer by category 2021

RECOVERY AND OPPORTUNITIES

Steady growth for beer after rebound in 2021 providing the virus comes under control and restrictions ease

After an initial rebound in 2021, recovery is expected to be more gradual, with sustained growth over the forecast period, following the expected reduction in confinement measures and recovery of the tourism industry. Providing the virus recedes, imported premium lager is anticipated to produce the highest growth in the forecast period in volume terms driven by the recovery projected for the on-trade channel after the large decline experienced in 2020. For the economy segment, the best performer in 2020, two different trends are likely to emerge: on one hand an anticipated difficult economic landscape could lead to a growing number of consumers downtrading their purchases; while on the other, the on-trade will capture a shift away from the off-trade where the economy segment maintains its highest share. Overall, the economy segment is likely to lose volume sales by the end of the forecast period in relation to 2020. Off-trade discounting campaigns are also expected to remain in place over the coming years, which could restrict growth of economy beer.

The reopening of society boosts innovation leading to greater diversity in beer

Innovation will continue to be an important trend over the forecast period which will add value to the category. This will lead to the launch of a greater diversity of beer styles and brands. With the development of handcrafted brands and the rise of microbreweries in recent years, it became easier to innovate and launch new flavours. Port wine, dried fruits, chocolate and spices are expected to be some of the inspirations for the 2021 winter flavours introduced by craft beer houses in the country. Craft beer will also see a rise as the on-trade recovers and begins operating more normally again while an end to the ban on music festivals, events and spectating at football games should stimulate greater dynamism in new product developments and promotions.

Growth in non/low alcohol beer in line with global trends

Consumers will increasingly seek different offers depending on the consumption occasion and their current needs. Despite the lower popularity of alcohol-free alternatives compared to other European countries, they will nonetheless represent a valued alternative. As such, the range is expected to develop through new product launches. The growing trend towards moderate alcohol consumption allied to an increase in inbound flows (alcohol-free is gaining increasing popularity in other EU countries) is also anticipated to boost non/low alcohol beer alternatives.

Portugal beer off trade vs on trade