PACRIM'S SUMMARY FOR CRAFT BEER IN SOUTH AFRICA

KEY DATA FINDINGS

Beer producers experience strong losses as COVID-19 leads to ban and restrictions on sales in 2020

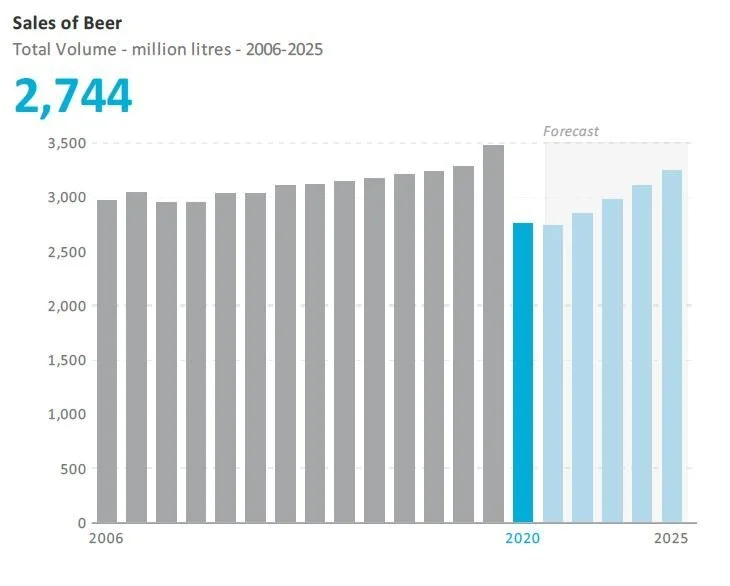

In 2020, total volume sales plummet by 21% to 2.7 billion litres. The only category to post total volume growth in 2020 is non-alcoholic beer, with a 113% sales rise

While retail beer sees a 3% increase in its average unit price in 2020, in the on-trade the rise is 32%

The South African Breweries Ltd leads total volume sales with a 79% share in 2020

Over the forecast period, sales are projected to generate a total volume CAGR of 3% and reach 3.2 billion litres in 2025

Beer in South Africa - Market Forecast 2021

COVID 19 IMPACT

Ban on alcoholic drinks decimates beer performance in 2020

Beer continues to be the overall largest category in volume terms, despite heavy decline in 2020. On-trade outlets were especially hard-hit by the government’s lockdown sales ban on alcoholic drinks, as beers are the most popular beverages sold in bars and restaurants, notably in 500ml draught units. Leading brands such as Carling Black Label, Heineken and Castle recorded major declines in both value and volume sales terms.

Over the review period several successful microbreweries and craft breweries entered the market, focusing on local beer offerings. One local player that is making significant gains against the large players such as The South African Breweries and Heineken would be Devil’s Peak. However, the local brewing industry took a massive knock because of the sales ban in 2020, with estimates that over 50 breweries closed down and hundreds of jobs were lost in this sector.

Despite the overall drop in sales, one beer category managed to register double-digit growth due to the sales ban, namely non-alcoholic beer. In total volume sales terms, its size more than doubled in 2020, with brands such as Devil’s Peak Hero, Heineken 0.0 and Beck’s Non-alcoholic experiencing exceptional growth owing to being available throughout the lockdown at supermarkets and traditional grocery stores.

Unisex beers on the rise

In regard to beer sales in South Africa, millennial female consumers are becoming increasingly important as society continues to drive the emancipation of women. There is evidence of a move towards more unisex beers targeting both men and women, with women typically more adventurous than their male counterparts, and willing to try something new.

Prior to the pandemic, millennials’ changing preferences supported the dynamic growth of flavoured/mixed lager – and this category actually only declined by a small amount despite the sales ban on alcohol in 2020. New product launches have been positioned as unisex offerings. For example, the recently introduced Flying Fish Chill has less sugar and carbohydrates, making it appealing to anyone watching their weight, as well as those interested in general health issues. Hansa Golden Crisp, introduced in the second half of the review period, was well received due to its light, easy-drinking nature and less bitter taste.

Competitive landscape still dominated by The South African Breweries

The South African Breweries Ltd, which offers everything from Budweiser to Castle, was in 2019 feeling the brunt of a long-running decline in beer demand globally suffered by its brand owner Anheuser-Busch InBev NV. However, the company intensified marketing campaigns, which boosted sales volumes. Its “no excuses” and “smash the label” campaigns yielded success as consumers responded well. Of particular note in 2019, however, was the performance of Castle Lite, which gained share due to consumers’ increasing interest in healthier beer options. The health trend also benefited Heineken, which in 2020 gained value share in South Africa’s beer category following the roll-out of Heineken 0.0 the previous year. This is an alcohol free lager brewed with a “unique recipe for a distinct balanced taste”. Furthermore, ithas only 69 calories per 330ml bottle, with 16g of carbs, compared with 138 calories and 10.5g of carbs in regular Heineken.

Meanwhile, the double-digit growth in sales of the Corona brand by The South African Breweries brand resulted in this beverage rising in the beer category’s rankings over 2018-2019, while it maintained its share in a pandemic-hit 2020. Imported beers such as Corona were growing faster than the overall beer industry prior to the global health crisis.

Sales of Beer by Category in South Africa 2021

RECOVERY AND OPPORTUNITIES

Performance to remain depressed while sales restrictions linger

As the industry starts to recover from the ban on alcoholic drinks, it is evident that players such as The South African Breweries and Heineken will continue to focus on their non-alcoholic beer offerings to regain lost volume and value sales. The main benefits of this category are that these offerings are cheaper to produce and do not face the stringent restrictions on sales and advertising applied to alcoholic beverages.

Currently, all retail sales of alcoholic beverages are still limited to four days a week and at shortened hours, while restaurants and bars have to close earlier than usual, dampening on-trade potential. Beer being such a strong category in the on-trade is estimated to decline slightly in 2021 unless these restrictions are fully lifted.

The ban resulted in The South African Breweries cancelling multi-billion-rand capital and infrastructure upgrades and led to the company reviewing its planned spending for 2021, while Heineken South Africa halted its plans for a ZAR6 billion brewery expansion. It is to be expected that volume growth potential in the next two years will be heavily reduced, especially if the largest two players disinvest in the industry.

Dipping purchasing power favours standard lager, while non-alcoholic beer and RTDs have promising future

There has been a move away from premium products to more affordable, economical alternatives as consumers face spending constraints as a result of COVID-19. In beer, standard lager is set to be more robust than premium lager in the first half of the forecast period, for example. Indeed, premium lager is poised for further decline in both off- and on-trade channels in 2021, although the on-trade may fare slightly better than retail due to channel shifts as South Africans slowly return to bars and restaurants.

Furthermore, with non-alcoholic beverages moved into supermarkets’ beverage aisles towards the end of the review period, non-alcoholic beer has experienced very strong growth since the initial lockdown and it is predicted to perform vibrantly again over the forecast period. Non-alcoholic beer will also post dynamic growth because it is still an emerging category, with sales increasingly benefiting from the health trend, especially so given the experience of COVID-19. Signal Hill Products, which offers a non-alcoholic beer within its Devil’s Peak range, has seen increased interest from consumers who would not necessarily have opted for a non-alcoholic beer prior to COVID-19 lockdown. Its Hero and Hero Twist of Citrus offerings have proven particularly popular.

Consumers predicted to keep pursuing lighter and more sophisticated beers

Flavoured/mixed lager has revitalised millennials’ interest in the beer category, and led to stability in declining beer volumes. While, prior to the pandemic, beer volumes were declining by 4% to 5% annually on the global stage, this was not as severe in South Africa, as craft beer and lager buoyed the trend towards more upmarket and premium products. Millennials were also shifting away from heavy, bitter beer varieties towards ighter and sometimes fruity-flavoured products. This supported the pre-pandemic growth of flavoured/mixed lager, which experienced only a small decline in total volume sales in 2020, with retail sales actually still rising slightly despite the ban and restrictions on alcohol sales.

Flavoured/mixed lager is poised to recover in 2021 thanks to the off-trade, the dominant channel for this beverage type, with its prices more appealing to a consumer base experiencing the financial fallout of COVID-19.

Craft beer, meanwhile, has already cemented its significance with an expansion of new products, as most craft brewers have an ale, a Weizen and even a stout in their portfolio, along with their flagship lager products. These categories are very niche, but before 2020 were nonetheless growing well, along with lagers. Their performance was due to the increasing variety of such products. This particularly appealed, as for a long time beer drinkers were only able to drink mainstream beer.

Craft beer addressed this and made beer more sophisticated. This revived consumer interest, helping to win consumers from wine. Prior to the craft beer boom, mainstream players only made lager because this was easier to sell to a wider audience. In the forecast period, as disposable incomes recover from the impact of the pandemic, sales of craft offerings are predicted to pick up again, although there is likely to be much change in the offering as many craft breweries were forced to close owing to heavy losses amid the crisis.